Fraudulent activity is a growing concern in the digital age. As financial transactions move increasingly online, fraudsters develop more sophisticated ways to deceive systems and steal resources. Protecting sensitive information and assets has become paramount, and this is where machine learning plays a pivotal role. Machine learning for fraud detection leverages data and patterns to automatically spot suspicious activities before they result in financial losses.

Understanding Fraud Detection

Fraud detection involves identifying and preventing deceitful activities that aim to steal money, goods, or sensitive information. There are various types of fraud, including payment fraud, identity theft, insurance fraud, and insider threats. Traditional methods of detecting fraud rely heavily on manual monitoring and predefined rules, which can only capture known patterns of fraud. However, the dynamic nature of fraud requires a more advanced approach, making machine learning indispensable.

Why Machine Learning for Fraud Detection?

While traditional fraud detection systems have been useful, they come with limitations. Rule-based systems are reactive, meaning they can only respond to fraudulent activities that match predefined criteria. This makes it hard to keep up with rapidly evolving fraud tactics. Machine learning addresses these shortcomings by learning from data and making predictions based on patterns it identifies. It’s not just about rules but about uncovering hidden fraud tactics that humans might miss.

In machine learning, the system can detect both known and unknown fraud patterns. For example, it can monitor large sets of transaction data, flagging anomalies based on behavior rather than fixed rules. This is what makes machine learning an excellent tool for fighting fraud in real-time.

How Machine Learning Works in Fraud Detection

At its core, machine learning for fraud detection relies on algorithms that process large volumes of data, learning from historical cases of fraud. The process begins with feeding the system past transaction data, including both fraudulent and legitimate ones. From here, the algorithm builds a model that can detect fraud by learning the behaviors associated with it.

Machine learning models for fraud detection often revolve around two key methods: supervised and unsupervised learning.

- Supervised Learning: This method involves training the model using a labeled dataset, where each example is marked as either fraudulent or non-fraudulent. The system then learns to classify future transactions based on the patterns it identifies in this training data.

- Unsupervised Learning: Here, the model analyzes transaction data without labeled outputs. Instead, it looks for anomalies or unusual patterns that deviate from the norm. Since fraudsters often employ new tactics, this approach can be highly effective in detecting previously unseen fraud types.

Key Machine Learning Techniques for Fraud Detection

- Supervised Learning: Techniques such as Decision Trees, Support Vector Machines (SVM), and Logistic Regression are often used for fraud detection. These models are trained on historical fraud cases and can provide predictions on whether a new transaction is likely to be fraudulent.

- Unsupervised Learning: Clustering techniques, such as K-means clustering, or autoencoders, are valuable in detecting anomalies in large datasets. These models group transactions based on similarities, making it easier to identify outliers that could indicate fraudulent behavior.

- Ensemble Learning: Combining multiple algorithms through methods like Random Forests and Gradient Boosting can significantly improve accuracy in detecting fraud. By leveraging the strengths of various models, ensemble methods can provide a more comprehensive approach to identifying fraudulent activities.

Building a Fraud Detection Model

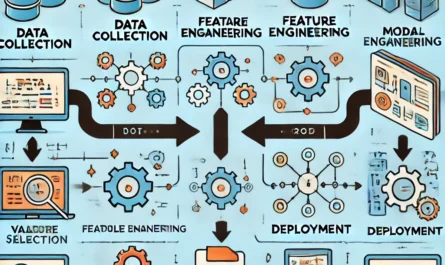

To build a machine learning model for fraud detection, follow these essential steps:

- Data Collection: Start by collecting data from various sources, such as transactional data, customer details, and behavioral patterns. High-quality data is critical for effective fraud detection.

- Data Preprocessing: Clean the data by removing duplicates, handling missing values, and standardizing formats. Preprocessing ensures that the dataset is ready for the machine learning algorithm.

- Feature Engineering: Develop features that highlight key aspects of the data, such as transaction frequency, location, or time. These features help the model distinguish between fraudulent and legitimate transactions.

- Model Training: Select the appropriate machine learning algorithm based on the nature of your data. Train the model on your dataset, and use cross-validation to optimize the model’s performance.

- Model Testing and Evaluation: Test the model on unseen data to ensure it can accurately predict fraud in new situations. Use metrics such as precision, recall, and the F1 score to evaluate the effectiveness of the model.

Data Preprocessing for Fraud Detection

Preparing your data for fraud detection is one of the most crucial steps in the process. In most real-world scenarios, data is messy and incomplete. Therefore, before feeding it into a machine learning model, it’s essential to perform data cleaning, handling missing values, and scaling features.

- Data Cleaning: Remove any irrelevant information or duplicates that could skew the analysis.

- Handling Missing Values: Often, fraud datasets have missing information, which needs to be imputed or discarded depending on its importance.

- Feature Scaling: Apply normalization or standardization techniques to ensure that the features are on a comparable scale, which helps many algorithms perform better.

Feature Engineering in Fraud Detection

Feature engineering involves creating new inputs from existing ones to improve the performance of machine learning models. For fraud detection, features could include transaction time, user behavior, geographic location, and transaction amount.

- Transaction Frequency: How often a user performs transactions could be an indicator of fraud, especially if the frequency suddenly spikes.

- Geolocation: Transactions occurring in unusual geographic locations can be a red flag for fraudulent behavior.

- Device Data: Information about the device used for the transaction can help identify if an unexpected device is being used.

By developing insightful features, machine learning models can detect patterns of fraud more effectively.

Supervised Learning Techniques

Supervised learning algorithms are trained using labeled datasets to predict whether a given transaction is legitimate or fraudulent. Common algorithms used in fraud detection include:

- Logistic Regression: A statistical method that predicts the probability of fraud based on a set of independent variables.

- Decision Trees: A tree-like structure that splits data into subsets based on conditions, allowing for straightforward classification of fraudulent activities.

- Random Forests: An ensemble learning method that improves accuracy by using multiple decision trees to make predictions.

Unsupervised Learning Techniques

Unsupervised learning techniques don’t rely on labeled data, making them ideal for detecting new or unknown types of fraud. These techniques aim to find outliers or anomalies in the data that could indicate fraud. Common techniques include:

- K-means Clustering: Groups similar transactions together, helping detect transactions that are outliers in terms of behavior.

- Autoencoders: Neural networks designed to compress and then reconstruct data, where fraud cases can be identified as those that differ significantly from expected patterns.

You can also read; How to Integrate AI into Mobile Applications

Real-Time Fraud Detection with Machine Learning

In financial systems, real-time fraud detection is critical to prevent losses and protect customer accounts. Machine learning models can be deployed in real-time to monitor transactions as they happen, flagging suspicious activity instantly. Payment gateways, banks, and online retailers increasingly rely on real-time fraud detection models to ensure security.

Real-time systems often use streaming data, where the model continuously learns and adapts from new data. This allows businesses to stay ahead of fraudsters by detecting and preventing fraud before it impacts their operations.