In today’s rapidly evolving digital landscape, financial institutions face an increasing threat from fraudulent activities. The need for effective and efficient fraud detection methods has never been more urgent. Artificial Intelligence (AI) is playing a transformative role in addressing these concerns by providing innovative solutions to detect and prevent fraud. This article explores how AI can be leveraged to strengthen fraud detection mechanisms within financial systems.

Understanding AI for Fraud Detection

AI, with its capacity for data analysis and pattern recognition, has become a crucial tool in detecting fraudulent activities. Fraud in financial systems often involves subtle patterns hidden in massive datasets. Traditional methods may struggle to keep pace with the ever-increasing volume of transactions and sophisticated tactics employed by fraudsters. However, AI thrives in such environments, analyzing vast amounts of data in real-time to identify suspicious behaviors and potential fraud risks.

AI-driven fraud detection models work by analyzing transaction data, identifying irregularities, and flagging anomalies that could indicate fraud. These systems are capable of learning from historical fraud cases, refining their detection abilities over time, and reducing false positives.

AI Techniques in Fraud Detection

Several AI techniques have emerged as critical tools for fraud detection in financial systems. Each method offers unique advantages, helping institutions mitigate risks and enhance security.

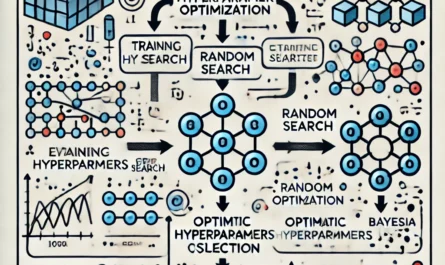

Machine Learning Algorithms

Machine learning, a subset of AI, plays a pivotal role in detecting fraud. By analyzing historical transaction data, machine learning models can identify patterns that distinguish legitimate transactions from fraudulent ones. Supervised learning models are often trained on labeled datasets, meaning they learn from previous instances of fraud and non-fraud transactions. Once trained, these models can assess new transactions in real-time and make predictions about their legitimacy.

Unsupervised learning, on the other hand, doesn’t rely on labeled data. Instead, it seeks out anomalies by identifying outliers—transactions that deviate from normal patterns. This approach is particularly useful for detecting novel types of fraud that may not have occurred in the past.

Natural Language Processing (NLP)

Natural Language Processing is another AI-driven technique used in fraud detection. NLP helps financial systems monitor text-based data, such as customer communications or transaction descriptions, for any signs of suspicious activity. By analyzing language patterns, it can detect inconsistencies or phrases commonly associated with fraud, alerting the system to potential threats.

For example, NLP can monitor social media and email communications for phishing attempts, where fraudsters impersonate legitimate entities to gain access to sensitive information. The ability to process and analyze text at scale enables financial institutions to spot these attacks before they cause damage.

Neural Networks

Neural networks, inspired by the human brain’s structure, are effective in detecting complex and subtle fraud patterns. Deep learning, a type of neural network, can process large amounts of data and identify intricate correlations that simpler algorithms might miss. Neural networks are excellent for recognizing patterns in transaction data, such as geographic inconsistencies or unusual spending behaviors, which could indicate fraudulent activities.

Deep learning models can also adapt to new types of fraud. As fraudsters evolve their tactics, neural networks can adjust their detection mechanisms by continuously learning from new data, ensuring they stay ahead of emerging threats.

Benefits of Using AI in Fraud Detection

The use of AI in fraud detection offers numerous benefits for financial institutions, providing enhanced accuracy, efficiency, and cost savings. Here’s why AI is becoming the go-to solution for fraud detection:

Real-Time Detection

One of the primary advantages of AI is its ability to detect fraud in real-time. Traditional methods often rely on manual checks or post-transaction reviews, allowing fraudsters to complete their actions before detection. AI-powered systems can analyze transactions as they occur, flagging suspicious activities instantly and potentially preventing fraudulent transactions from being completed.

Reduction of False Positives

AI can significantly reduce false positives—a common challenge in fraud detection. Financial systems need to strike a balance between catching fraud and ensuring legitimate transactions aren’t wrongly flagged. AI models, particularly those using machine learning, can refine their detection algorithms to differentiate between normal and suspicious behaviors more accurately, reducing the number of false alarms.

Scalability and Efficiency

Financial systems handle an enormous volume of transactions daily. Manually reviewing each transaction for signs of fraud would be both time-consuming and inefficient. AI can process thousands of transactions in a fraction of the time, providing financial institutions with the scalability they need to manage large volumes without compromising on security.

Learning and Adaptation

AI systems can continuously learn from new data, adapting to evolving fraud tactics. Fraudsters are constantly developing new techniques, but AI models are built to evolve as well. By analyzing new fraud cases and incorporating feedback, AI can adjust its detection parameters to stay one step ahead of criminals.

Implementing AI for Fraud Detection: Key Considerations

While AI offers tremendous potential for fraud detection, its implementation requires careful planning and consideration. Financial institutions must navigate various challenges to ensure successful deployment.

Data Quality and Quantity

AI models rely heavily on data to function effectively. The quality and quantity of data available for training these models will significantly impact their accuracy. Financial institutions must ensure they have access to comprehensive, clean datasets to train their AI systems effectively. This data should encompass a wide range of transaction types, customer behaviors, and fraud scenarios to improve the model’s performance.

Regulatory Compliance

Financial systems are subject to strict regulatory requirements, especially when it comes to fraud detection and reporting. Any AI-based system must comply with existing regulations, such as GDPR or PCI DSS, ensuring that customer data is handled securely and ethically. It’s essential to integrate AI solutions that can operate within the regulatory frameworks governing the financial industry.

Ethical Considerations

The use of AI in fraud detection also raises ethical concerns, particularly regarding privacy and bias. Financial institutions need to ensure their AI systems are transparent and do not inadvertently discriminate against certain groups. Ensuring that AI models are free from bias is crucial for maintaining trust with customers and regulators.

Challenges of AI in Fraud Detection

While AI provides substantial benefits, it is not without its challenges. Institutions need to be aware of potential obstacles when leveraging AI for fraud detection.

Data Privacy and Security

One of the most significant challenges is ensuring data privacy and security. AI systems require vast amounts of sensitive financial data to function effectively. Protecting this data from breaches or misuse is paramount. Financial institutions must implement robust cybersecurity measures to protect their AI systems from attacks, ensuring customer data remains secure.

Model Interpretability

AI models, particularly deep learning systems, can be complex and difficult to interpret. Financial institutions must ensure their AI models are transparent and understandable, especially when dealing with regulatory bodies. Explainable AI (XAI) is an emerging field that aims to make AI models more interpretable, allowing institutions to explain how decisions were made, particularly when rejecting or flagging transactions as fraudulent.

Continuous Monitoring and Updating

AI models must be continuously monitored and updated to remain effective. Fraud tactics evolve rapidly, and a static AI model will quickly become obsolete. Financial institutions must have processes in place to update their AI models regularly, ensuring they can detect new types of fraud.

Best Practices for Leveraging AI in Fraud Detection

To maximize the benefits of AI in fraud detection, financial institutions should adopt best practices that ensure successful implementation and ongoing effectiveness.

Invest in AI Training and Expertise

Building and maintaining AI-driven fraud detection systems requires specialized knowledge and expertise. Financial institutions should invest in hiring AI experts or training existing teams to manage these systems effectively. A knowledgeable team can fine-tune AI models, ensuring they perform optimally and adapt to new challenges.

Collaboration with Industry Partners

Fraud detection is not an isolated endeavor. Collaborating with other financial institutions, regulatory bodies, and AI solution providers can provide valuable insights into emerging fraud trends and best practices. Sharing data and knowledge across the industry can help institutions stay ahead of fraudsters.

Maintain a Human-in-the-Loop Approach

While AI can automate much of the fraud detection process, human oversight is still essential. Maintaining a human-in-the-loop approach ensures that AI models remain accountable, and decisions are subject to human judgment. This approach can help mitigate the risk of false positives and ensure that legitimate transactions aren’t unfairly flagged.

You can also read; How to Integrate AI into Mobile Apps for Better User Experience

Leveraging AI for a Safer Financial Future

In conclusion, leveraging AI for fraud detection in financial systems represents a significant advancement in the fight against financial crime. By harnessing the power of AI, financial institutions can detect fraud more accurately, respond faster, and protect their customers from evolving threats. However, successful implementation requires careful consideration of data quality, regulatory compliance, and ongoing monitoring. When deployed effectively, AI can be a game-changer, providing the financial industry with the tools it needs to stay one step ahead of fraudsters.